WHAT IS ISO 31000

Risk management is an increasingly important business driver as stakeholders have become much more concerned about risk. ISO 31000 is the next-generation standard for risk management where it compliments all existing standards and recommends a new approach and concept for easier and more effective risk management. The main idea behind ISO 31000 is to link risk management to decision-making and performance, helping managers to make risk-based decisions under uncertainty to achieve objectives. It can be used by any organization regardless of its size, activity or sector. Using ISO 31000 can help organizations increase the likelihood of achieving objectives, improve the identification of opportunities and threats and effectively allocate and use resources for risk treatment.

ISO 31000 seeks to provide a universally recognized paradigm for practitioners and companies employing risk management processes to replace the myriad of existing standards, methodologies and paradigms that differed between industries, subject matters and regions.The core objective of ISO 31000 is not to support the process of risk management but, to provide with a framework for managing risks in a strategically effective manner. Based on the requirements of an organization over its risk management strategy, the framework of the RMS will comprise its planning, policy and procedures that is actually followed by them. The strategy should be such that the organization should achieve its business objective through the support of risk protocols which in detail describes the procedures to implement the strategy to manage risk effectively. The ISO 31000 standard specifies framework that consists of essential steps that needs to be followed towards the implementation and ongoing support of any risk management process. They are,

- Develop an effective ERM Framework

- Continuous Monitor and Review of the ERM Framework

- Device Risk Management Strategies

- Design of ERM Framework

RISK MANAGEMENT PRINCIPLES:

The design and implementation of risk management plans and frameworks will need to take into account the varying needs of a specific organization, its particular objectives, context, structure, operations, processes, functions, projects, products, services, or assets and specific practices employed. A successful enterprise risk management (ERM) initiative can affect the likelihood and consequences of risks materializing, as well as deliver benefits related to better informed strategic decisions, successful delivery of change and increased operational efficiency. Other benefits include reduced cost of capital, more accurate financial reporting, competitive advantage, improved perception of the organization, better marketplace presence and, in the case of public service organizations, enhanced political and community support.

Some of the Principles that requires to be highlighted when it comes to risk management are:

- 1)Creates and protects value

The main objective of an effective risk management for an organization it to achieve business goals seamlessly. However, this is achieved through a thorough review of the organisation’s process and systems and devising the ERM framework based on them.

- 2)Be an integral part of organisational processes

It is very much essential to have the organisation’s governance principles to be in close integration with that of the ERM system. It is to enable a better planning process at every level of organization processes and strategies.

- 3)Be part of decision making

An effective risk management should offer better assistance towards decision making to be aware informed choices, identify priorities and to select the most appropriate action.

- 4)Explicitly address uncertainty

It provides the organisations with highly viable opportunities to identify potential risks and implement suitable solutions to maximise the chance of gain while minimising the chance of loss.

- 5)Be systematic, structured and timely

ERM system should be streamlined across the organization in order to achieve efficiency, consistency and the reliability of results everytime.

- 6)Based on the best available information

For an effective risk management skill, it is important to understand and consider all available information relevant to an activity and to be aware that there may be limitations on that information. It is then important to understand how all this information informs the risk management process.

- 7)Be tailored

Depending upon the nature of the organization, its ERM framework should take into account the internal and external operating environment and its risk profile.

- 8)Take into account human and cultural factors

The contributions of people and environment/cultural for an organization is very much important for an organization and an effective ERM should consider and value it aswell.

- 9)Be transparent and inclusive

Engaging stakeholders, both internal and external, throughout the risk management process recognises that communication and consultation is key to identifying, analysing and monitoring risk.

- 10)Be dynamic, iterative and responsive to change

The process of managing risk needs to be flexible. The challenging environment we operate in requires agencies to consider the context for managing risk as well as continuing to identify new risks that emerge, and make allowances for those risks that no longer exist.

- 11)Facilitate the continual improvement of organisations

Agencies with a mature risk management culture are those that have invested resources over time and are able to demonstrate the continual achievement of their objectives.

RISK MANAGEMENT PROCESS

The ISO 31000:2018 standard is based on the same wider process likewise the AS/NZS 4360:2004 for managing risk after considering numerous options and variants,. The process undergoes a series of iteration at each phase and continuously applies to the elements of communication, consultation, monitoring and review.

- Stage one: Establishing the context

In the first stage of the ISO 31000 risk management process, organizations should establish the context of the risk assessment as it relates to both internal and external factors. The most important deliverable from this stage is establishing the objectives and scope of the risk assessment. The organization should have a clear statement of purpose for the assessment and everyone involved should understand what business processes and technologies are included within the assessment's scope.

After setting the objectives and scope, the organization should spell out the factors affecting the assessment. This should include external factors such as the legal and regulatory environment, political considerations, economic circumstances and the views of external stakeholders. It should also include internal factors such as the organizational structure, corporate governance, business processes and technologies.

- Stage two: Risk assessment

The risk assessment phase has three goals: risk identification, risk analysis and risk evaluation. During the risk identification step, the organization develops a comprehensive list of the risks that might prevent it from achieving its objectives, as well as the causes and possible outcomes of those risks materializing. This information is considered carefully during the risk analysis, where the organization conducts qualitative and/or quantitative assessments of those risks. The risk assessment stage culminates in the risk evaluation step, where the organization decides which risks are significant enough to require active management and prioritizes that list.

- Stage three: Risk treatment

During the risk treatment stage, more commonly referred to as the risk management stage, the organization implements controls designed to reduce risk, assess the effectiveness of those controls and implement additional controls on an as-needed basis. The controls performed during the risk treatment stage may include measures designed to decrease the probability or impact of a risk, avoid a risk entirely by altering business processes, take justified risks, and

transfer the risk to third parties, such as insurance companies.

In addition to the three core stages of the risk assessment process, ISO 31000 recognizes that there are two equally important complementary processes that should occur at every stage of the assessment: communication and consultation, and monitoring and review. Organizations conducting an assessment should keep stakeholders informed throughout the process and conduct monitoring to ensure the process is effective.

WHO SHOULD USE ISO 31000

ISO 31000 regulates the requirements of risk management process and introduces the methodology of risk analysis. Operational risk management supports your organisation’s decision-making by identifying and responding to threats that may have an adverse effect on the organisation’s operations or goals. ISO 31000:2009 gives a set of general options to be considered when risk is treated. The order of the list reflects preference. They are:

- Avoiding the risk by deciding not to start or continue with the activity that gives rise to the risk;

- Taking or increasing the risk in order to pursue an opportunity;

- Removing the risk source;

- Changing the likelihood;

- Changing the consequences;

- Sharing the risk with another party or parties (including contracts and risk financing);

- Retaining the risk by informed decision.

ISO 31000:2018 can be used by any public, private or community enterprise, association, group or individual. Therefore, ISO 31000:2018 is not specific to any industry or sector. ISO 31000:2018 can be applied throughout the life of an organization, and to a wide range of activities, including strategies and decisions, operations, processes, functions, projects, products, services and assets.It also facilitates the application of many sector-specific standards, especially in the financial sector but also for IT, medical devices, or the automotive industry.Some of the major featuresof an effective ERM in place would endeavor with,

- Applicable to all types of risk; Strategic, Operational, Financial, Compliance and Reporting Risks

- Risk assessment can be performed on a risk event, thus eliminating the need for asset-based risk assessment.

- Risk has positive impact, rather than just negative impact.

- Include risk as part of business decision-making

- Contain requirements for implementing Risk Management System (RMS)

- Recommended as suitable for compliance with ISO standards (such as ISO 27001: 2013).

For organisations in any sector, ERM is an effective tool who wishes to perform early detection and analysis of the risks in a highly efficient manner. The implementation of Risk Management increases both the awareness of risk and of opportunity, and their pro-active approach helps to ensure positive business development in the future. ISO 31000:2018 can be applied to any type of risk, whatever its nature, whether having positive or negative consequences.

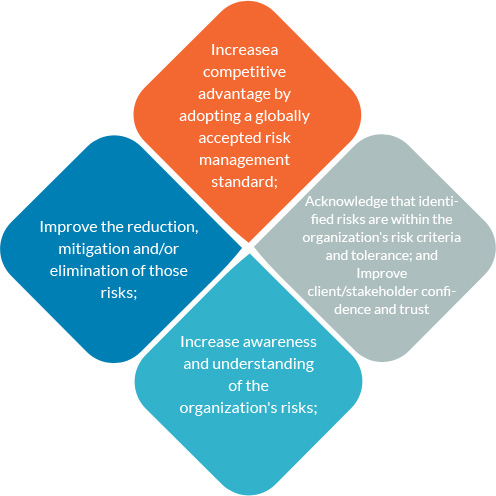

BENEFITS OF ISO 31000

- In the majority of government tender’s nowadays, ISO certificate is mandatory.’

- ISO certificate increases the credibility of your organization on a global level.

- ISO certification in turn guarantees a better customer satisfaction.

- ISO certification results in proved quality of products.

- Supplies facts for the evaluation of performance and results,

- Manages opportunities as well as risks Increase the likelihood of achieving objectives

- Develop a risk management strategy and contingency plans

- One integrated system to identify, analyze and evaluate risks

- Strategic early warning system

- Minimize the uncertainty of outcomes

- Ensures the availability of resources, financial and otherwise

- Customer satisfaction - through delivery of products that consistently meet customer requirements as well as quality, safety and legal requirements

- Reduced operating costs - through continual improvement of processes and resulting operational efficiencies

- Improved stakeholder relationships - including staff, customers and suppliers

- Legal compliance - by understanding how statutory and regulatory requirements impact the organization and its customers

- Improved risk management - through greater consistency and traceability of products and use of risk management techniques

- Proven business credentials - through independent verification against recognized standards

- Ability to win more business - particularly where procurement specifications require certification as a condition to supply in a highly regulated sector